I’AM Vicki ‘Giana’ Greco and I help Nevada-based businesses of all sizes get set up, licensed, and running in no time.

I'AM Vicki 'Giana' Greco and I help Nevada-based businesses of all sizes get set up, licensed, and running in no time.

We offer the following services; New Business Start-up, Non-Profit Startup, Business Plans & Proposals, Health Department, Regulated, Privileged Licensing (Liquor, Gaming, Tobacco), and more!

Silent G Consulting is a woman-owned full-service business licensing firm helping to start and expand your business. With over 30 years of combined experience, our dedicated business specialists drive and execute the right strategy to streamline the license application process for business enterprises.

Which Path Do You Want To Start With?

We Take A Different Approach

We believe in developing the whole person, not just the business – so you can achieve 7-figure revenues while maintaining personal balance and clarity.

That’s why we offer comprehensive coaching, consulting, and exclusive productivity tools to transform your business, money, health, time, and life without the overwhelm. A whole approach for a whole person.

Whether it’s starting to love your business again, getting the marketing running on auto-pilot, reclaiming your personal life, better time management, or anything else entrepreneurs face, we’ve got your back.

Vicki “Giana” Greco is a spiritual guide, community leader, and transformational presence in Las Vegas and beyond. With a Juris Doctorate in law and more than 25 years as an entrepreneur, she has supported countless visionaries in bringing their businesses and dreams to life with both purpose and integrity through her business, Silent G Consulting, LLC, where she embodies the 5G’s: God, Gratitude, Grace, Grounding, and Growth.

Her own journey of deep healing and transformation awakened a calling to merge business with Spirit. Today, G is recognized as a backbone of the Las Vegas spiritual community, where she mentors, uplifts, and helps others embody their highest potential.

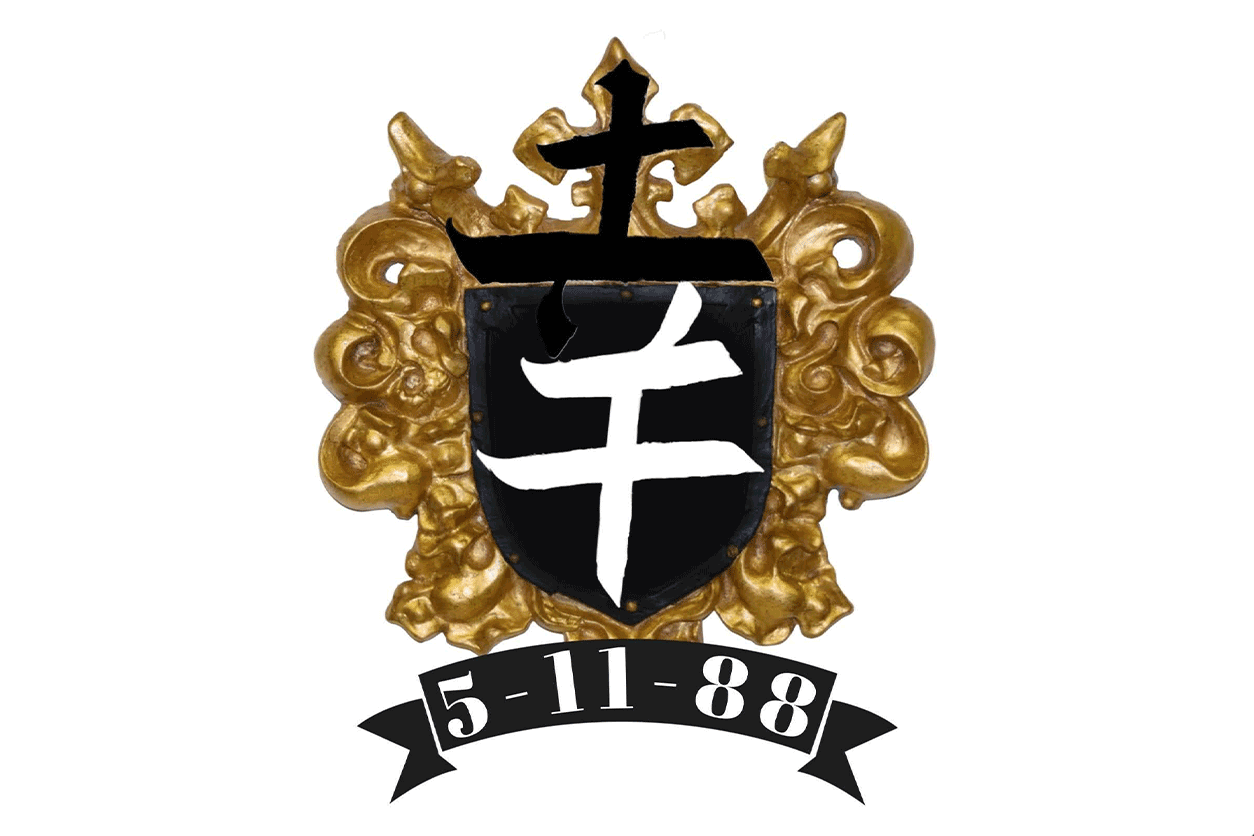

She is the founder of The Frankie Foundation 5-11-88, a nonprofit dedicated to supporting children grieving the loss of parents and siblings, and serves on compliance advisory boards for multiple nonprofits.

G’s spiritual path has led her to The Global Center for Christ Consciousness, where she has remembered her identity as a Daughter of Heaven — one of a rare circle of light workers who embody the Divine Mother and assist in “birthing” spiritual awareness in others through Christ Consciousness. She anchors the presence of God in all she does.

Silent G offers a safe and swift business experience. We focus on God, Gratitude, Grace, Ground and Growth. Everything is of God, and we must have gratitude for everything. Grace comes from compassion and forgiveness. Once you’re Grounded, you are able to GROW your business.

At Silent G, we do all things GOOD for your business.

Silent G offers a safe and swift business experience. We focus on God, Gratitude, Grace, Ground and Growth.

Everything is of God, and we must have gratitude for everything. Grace comes from compassion and forgiveness. Once you’re Grounded, you are able to GROW your business.

At Silent G, we do all things GOOD for your business.

Here’s what you can expect with Silent G Consulting on your team:

A Resourceful Team

Streamline Operations

Save Time

Save Money

Fast Turnarounds

Do you need fast results? – Good, that’s precisely what we deliver.

Let’s face it, getting a business up and running is tough and not for the weak of heart. With so many regulatory issues, it’s easy to start feeling…

Frustrated

Overwhelmed

Depressed

If you try to do these things by yourself, you can end up with:

Wasted Expenses

Submitting Wrong Forms

Missing Deadlines

The good news is you don’t have to worry anymore. We’ve got you covered at Silent G Consulting with a team of proven experts ready to work and help you get your business set up and licensed in Nevada in no time.

Meet The Entrepreneurs Who Have Found

Success Working With Silent G Consulting:

G on The Problem Solver Podcast

David Kohlmeier of The Problem Solver Podcast interviews G from Nevada Small Business Consulting.

G on The Problem Solver Podcast P2

David Kohlmeier of The Problem Solver Podcast interviews G from Nevada Small Business Consulting.

The Vape Smoke Shop Testimonial

I love G. I believe she’s very intelligent and strong. Qualities I strive to be as a woman.

FAQ's

Other on line websites claim to complete all filings for business formation for you. However there is no direct contact, and they charge extra hidden fees for everything. Instead of wasting money on these sites, Silent G Consulting, LLC offers every customer direct contact with G directly. We will give you a free phone consultation and create a package that fits all your small business needs. We promise there will be no hidden charges and your complete package is GUARANTEED to cost less than other on line websites.

Business plans can be divided roughly into four distinct types. There are very short plans, or miniplans, presentation plans or decks, working plans, and what-if plans. They each require very different amounts of labor and not always with proportionately different results.

What are the three main purposes of a business plan?

- Establish a business focus. The primary purpose of a business plan is to establish your plans for the future.

- Secure funding.

- Attract executives.

What is a business proposal?

A business proposal is a document used by a B2B or business-facing company (this may not always be the case) where a seller aims to persuade a prospective buyer into buying their goods or services. This includes basic information, like your company’s name and contact information, your company logo, your client’s name and contact information, the date, and a title. It makes the proposal look neat, organized, and well put together.

An LLC, or limited liability corp. is a business structure that combines elements of a sole proprietorship, partnership and corporation to protect the owners of a company from liabilities and debts. An LLC business structure protects your personal assets if you’re being sued. Likewise, if the LLC files for bankruptcy, the owners — also known as members— don’t have to pay the business debts with their personal funds. However, for taxes, the LLC resembles a sole proprietorship, so the LLC does not pay taxes itself. Instead, the owners include profits and losses on their personal taxes. The LLC can tax itself as a corporation, but in that case it must follow tax and filing requirements for corporations.

A corporation is a business structure separate from its owners. Corporations have the same rights as individuals. They can hire employees, borrow money, file lawsuits, own assets, pay taxes and enter contracts. Limited liability is a crucial defining aspect of corporations because it allows shareholders to take part in profits through stocks and dividends without being personally responsible for the corporation’s debts.

Here’s a look at the primary differences between LLCs and corporations:

Taxes

One of the greatest differences between LLCs and corporations is how they’re taxed. An LLC is taxed as a pass-through entity, meaning that profits pass through to the members — or owners — and are reported on the owners’ personal tax returns. The owners deduct business expenses to offset other incomes on their tax return and reduce their personal tax liability. Reporting profit and losses on personal tax returns typically makes filing taxes for an LLC simpler than it is for a corporation.

Corporations are always taxed as a separate entity. Corporations are responsible for paying taxes on their profits and shareholder dividends. Because dividends aren’t tax-deductible, they’re taxed twice. However, corporation-exclusive federal deductions offset this double taxation.

Business Ownership

Ownership is another major difference between LLCs and corporations. An LLC has the freedom to distribute ownership of the company to any or all members without regard for how they contributed financially. A corporation issues and sells percentages of the business to shareholders. Shareholders purchase more stock to own a larger percentage of the company or sell stock to own less. A corporation exists separate from each individual, so regardless of whether the original owner leaves, the corporation remains fully intact.

Management

LLCs have a more flexible management structure. An LLC can be managed by the owners or a manager. When a manager oversees the daily operations of the LLC, the owners typically don’t have an active role in the business operations.

With a corporation, a board of directors generates profits and assigns a corporate officer to manage daily operations. The owners, or shareholders, typically don’t have any involvement in daily operations outside of possibly approving major decisions.

Reporting requirements

Both LLCs and corporations must fulfill reporting requirements set by their state. Since the board of directors must vote on any changes to the business, corporations have to hold an annual shareholder meeting and file annual reports. LLCs, on the other hand, are not required to hold annual meetings or have a board of directors. Though they have to complete state-mandated reporting retirements, they have far fewer requirements than corporations.

Who can help you decide between an LLC and a corporation?

Choosing between an LLC and a corporation is a complex decision. Because the type of structure you choose has major tax consequences and every business is unique, consider talking to a professional before making a decision. Two professionals you can consult include:

- Attorney: An attorney who has experience with both LLCs and corporations can examine your business plan and recommend the best structure.

- Certified Public Accountant (CPA): You may also want to talk to a CPA who can fully explain the tax consequences for each business entity.